Online transactions have become an integral part of our daily lives in this digital era. With the increasing popularity of e-commerce and digital services, ensuring the safety and security of our online payments is crucial.

State Bank, a leading financial institution, offers a solution in the form of a State Bank Virtual Card. This article will explore what a State Bank Virtual Card is, how it works, and its benefits.

Basically, the SBI Virtual Card is a temporary tangible credit card. It’s having a 24 to 48 hours span. This is the temporary credit card for online purchases.

To get this feature, first, you need to apply for internet banking service in your SBI branch. After receiving the internet banking login credentials, log in into the bank account and apply for a virtual credit card free of cost.

In this article, we will learn about what exactly a digital wallet is, what to look out for when shopping online, and how virtual cards give us maximum security.

What is a State Bank Virtual Card?

A State Bank Virtual Card is a digital payment solution that provides a secure and convenient way to make online transactions.

It functions as a virtual representation of your physical debit or credit card, allowing you to shop online without sharing your card details.

The virtual card is generated instantly, and its details can be used to complete online purchases.

How does it work?

When you request a State Bank Virtual Card, a unique 16-digit card number, CVV, and expiration date are generated.

These details can be used to make payments on websites that accept Visa or Mastercard.

Each virtual card is valid for a limited duration or a specified number of transactions, adding an extra layer of security.

Benefits of using a State Bank Virtual Card

Using a State Bank Virtual Card offers several advantages:

- It enhances security by preventing your card details from being exposed during online transactions.

- It allows you to control and manage your online spending by setting transaction limits and validity periods for each virtual card.

- Virtual cards can be easily generated and used for one-time purchases, reducing the risk of fraudulent activities.

How to Get a State Bank Virtual Card

You must follow a simple application process to obtain a State Bank Virtual Card. State Bank provides virtual cards to its eligible customers, and the activation process is quick and hassle-free.

a. Application process

To apply for a State Bank Virtual Card, you can visit the bank’s official website or mobile app. Fill in the required information, such as your name, account details, and contact information. Once your application is submitted, it will be reviewed by the bank.

b. Eligibility criteria

State Bank may have certain eligibility criteria for issuing virtual cards. These criteria typically include being an existing customer of the bank and meeting specific account requirements. It is advisable to check the bank’s website or contact customer support for detailed eligibility information.

c. Activation process

Upon approval of your application, you will receive the virtual card details, including the card number, CVV, and expiration date. You can activate the virtual card by following the provided instructions. Once activated, you can start using the virtual card for online payments.

How to create State Bank Virtual Card?

Virtual credit cards, also known as virtual payment cards or digital credit cards, differ from physical credit cards in that they do not have a physical card. Instead, a virtual credit card makes a new credit card number for each transaction. This is usually used for online purchases and payments.

To obtain a State Bank virtual card, you must first be an SBI customer and have an internet banking account.

If you meet these requirements, you can follow these steps to obtain and use a state bank virtual card:

Step 1: Login into Internet Banking

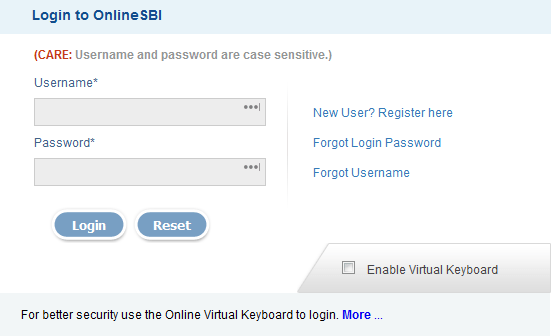

Sign in to your online banking account and choose the virtual card option. First, sign in to your SBI online banking account.

Go to “Personal Banking > Login.”

Click on the “e-Card” option on the right side.

Step 2: Choose the e-Cards section

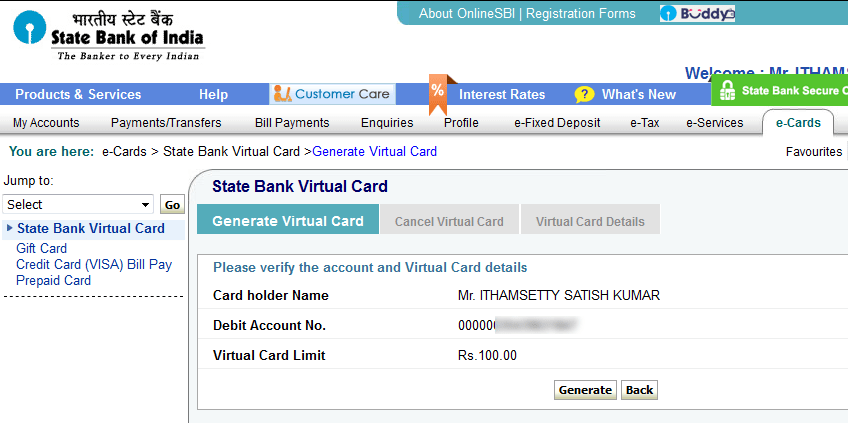

In the e-Card, option-click on the Generate Virtual Card option, then enter the Virtual Card Limit.

Put a tick mark next to accepting the terms and conditions. Then click on Generate

Remember: the limitation of the card should be between Rs. 1000 and Rs. 50000. This card’s limit of Rs. 50,000 cannot be exceeded.

Step 3: Generate a State Bank Virtual Card

You will be asked for a confirmation by SBI, so click on the “Generate” button.

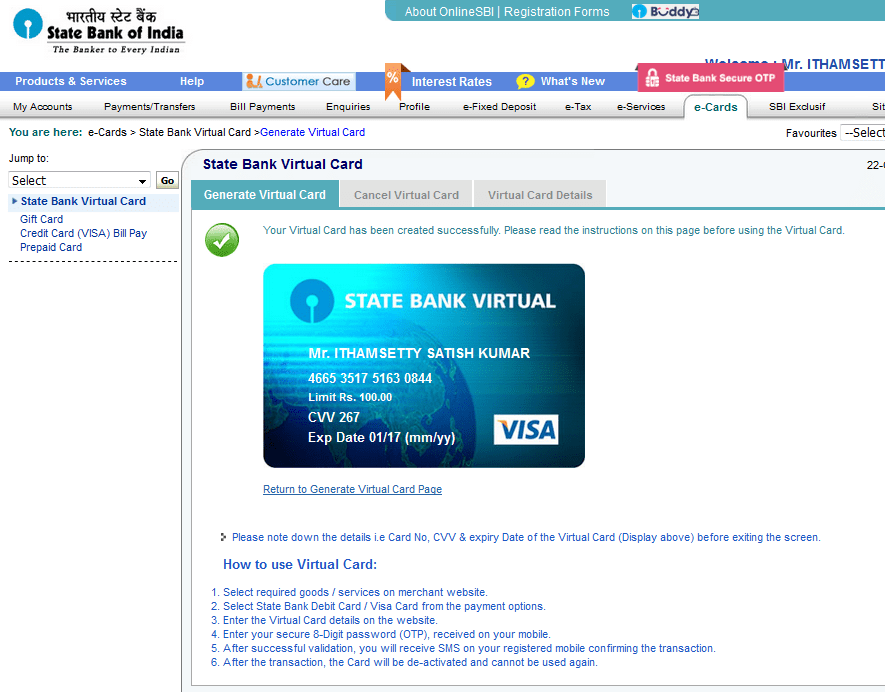

Step 4: Confirm it

You will receive the one-time passwords (OTPs) to your registered mobile number from the SBI net banking server. Simply enter the OTP in the appropriate boxes. It is a validation of one time password.

After a few seconds, your SBI Virtual Card is ready. Get an instant credit card number (a 16-digit Visa card number), the name of the cardholder, CVV number, and expiry date of the card. The SBI Virtual Card would look like this.

Step 5: SBI Virtual Credit card is Ready

After receiving the SBI VC, there is no need to store the virtual card details. If you want the details, you can retrieve them from the “Virtual Card Details” tab.

Using a state bank virtual card is a convenient and secure way to make online purchases and payments. The unique credit card number for each transaction adds another level of security and helps stop fraud and identity theft.

Features and Limitations

State Bank Virtual Card has various features and limitations to ensure secure and controlled usage.

a. Security measures

State Bank implements robust security measures to protect your virtual card transactions. These measures include encryption, multi-factor authentication, and real-time transaction monitoring. In case of any suspicious activity, the bank’s fraud detection systems immediately notify you, ensuring the safety of your funds.

b. Usage limitations

To prevent misuse, State Bank Virtual Cards have certain limitations. Each virtual card is valid for a specific period or a predefined number of transactions, after which it becomes invalid. This limitation adds an extra layer of security and prevents unauthorized use of the virtual card.

c. Integration with digital wallets

State Bank Virtual Cards can be linked with popular digital wallets like Google Pay or Apple Pay. This integration enables seamless transactions and provides additional convenience when making online payments.

Where to use this SBI Virtual Card?

- The Virtual card is very good for Online shopping, movie ticket booking, and Railway ticket bookings.

- This is the temporary credit card for online purchases.

- This card validity is 24 to 48 hours or sometimes until the completion of the transaction.

- When you complete an online transaction, the payment will be debited from your bank accounts.

- The bank does not charge for the Virtual card creation and cancellation.

- You can generate a number of Cards at a time.

- This currency card is in Rupees. You can use these cards in India, Bhutan, and Nepal.

- This is the more secure way to pay money online.

- It has a disadvantage too. The coverage is limited as it can be used only in India, Nepal, and Bhutan. The validity of this card is too short. It makes use of OTP.

What are the benefits of SBI Virtual Cards?

The card does not have a magnetic stripe or a PIN code, as it is not intended for use at an ATM or POS terminal. With it, you can make payments on websites around the world like a credit card.

However, it is not a credit product, so you do not need to prove income to get it or think about interest or installments.

- No card issuance fee

- Free of charge for transactions on the Internet or by telephone

- No fee for locking (unlocking) and unlocking (unlocking)

- Easily transfer amounts to and from the Virtual Card

- You have the opportunity to receive up-to-date information and manage the funds on the prepaid card and on all your other accounts anywhere and anytime;

- Periodic payments – through this service, you can subscribe for automatic payments from and on the Virtual Card, according to parameters set by you in advance – amount, the interval between payments, date of first payment.

SBI virtual card provides an easy and secure way of transacting online without providing the primary card/ account information to the merchant. it reduces the risk of exposing entire credit/ debit limit/ as the primary card/ account information.

Tips for Using a State Bank Virtual Card

While using a State Bank Virtual Card, it is essential to keep a few tips in mind to ensure a safe and pleasant online shopping experience.

a. Safe online transactions

When making online transactions with your virtual card, ensure the website is secure and reputable. Look for the padlock symbol in the browser’s address bar, indicating a secure connection. Avoid sharing your card details on unencrypted or suspicious websites.

b. Monitoring and managing expenses

One of the advantages of using a virtual card is the ability to track and manage your expenses more efficiently. Regularly review your transaction history and statements to identify unauthorized transactions or discrepancies. Set transaction limits and validity periods according to your spending habits and preferences.

c. Avoiding phishing scams

Be cautious of phishing scams that trick you into revealing your virtual card details. State Bank will never ask for your virtual card information through email or phone. Do not click on suspicious links or provide sensitive information unless you are certain about the authenticity of the request.

Frequently Asked Questions (FAQs)

How long does it take to receive a State Bank Virtual Card?

The time to receive a State Bank Virtual Card may vary depending on the bank’s processing time. After the application is approved, it typically takes a few business days to receive the virtual card details.

Can I use a State Bank Virtual Card for international transactions?

State Bank Virtual Cards can be used for international transactions, provided the website or merchant accepts Visa or Mastercard payments.

Is there a limit on the number of transactions I can make with a State Bank Virtual Card?

State Bank Virtual Cards have a predefined limit on the number of transactions or a validity period. Once the limit is reached, the virtual card becomes invalid.

Can I link my State Bank Virtual Card to multiple digital wallets?

State Bank Virtual Cards can be linked to multiple digital wallets, offering flexibility and convenience when making online payments.

How can I deactivate or cancel my State Bank Virtual Card?

Contact the bank’s customer support or visit the nearest branch to deactivate or cancel your State Bank Virtual Card. They will guide you through the steps to ensure the virtual card is inactive.

Conclusion

State Bank Virtual Card is a reliable and secure solution for making online payments. By using virtual cards, you can protect your actual card details, control your online spending, and enjoy a hassle-free online shopping experience. With its integration with digital wallets and robust security measures, State Bank Virtual Card ensures convenience and peace of mind for all online transactions.

Hello Satish,

I have been using SBI’s internet banking for more than a year now but never even cared to look out for such option. Thanks a lot for making all the SBI net banking users aware of this.

I have a small question, Can this virtual credit card make international payments?

Thank You,

Karan

Hello karan,

SBI virtual card is one of the good feature for regular online shopping users.

But this VC is for domastic purpose.

It is useful for secured online transactions with in india only.

You can use this any india online shopping sites.