In today’s digital-first economy, virtual credit cards (VCCs) are revolutionizing online payments. With cybercrime and fraud on the rise, consumers and businesses are turning to secure, disposable card numbers for safer transactions.

The global virtual card market is projected to reach $567 billion in 2025, growing at 19.7% annually (Source: The Business Research Company). Whether you’re shopping online, managing subscriptions, or handling business expenses, VCCs offer unmatched security and flexibility.

This comprehensive guide explores everything you need to know about virtual credit cards in 2025. It covers how they work, top providers, security benefits, and future trends.

What is a virtual credit card?

A virtual credit card (VCC) is a digital payment card. It functions like a traditional credit card, but it does not have a physical form. Instead, it generates a unique 16-digit card number, CVV, and expiration date for secure online transactions.

Key Features of Virtual Credit Cards:

- No physical card: The card only exists in a digital format.

- Disposable or reloadable: Can be single-use or reusable.

- Spending controls: Set limits on transaction amounts.

- Enhanced security: Shields your real card details from fraud.

How Do Virtual Credit Cards Work?

Virtual credit cards operate through banking apps, payment platforms, or fintech providers.

Here’s how they work:

- Generation: Your bank or provider creates a temporary card number linked to your real account.

- Usage: Use the virtual card details (number, CVV, expiry) for online purchases.

- Transaction Processing: The merchant charges the virtual card, and funds are deducted from your real account.

- Expiration: Single-use cards expire after one transaction, while multi-use cards can be reused.

Example Scenario:

- You want to buy from an unfamiliar website.

- Instead of entering your real credit card, you use a virtual card with a $50 limit.

- Even if the site is hacked, your real card details remain safe.

Types of Virtual Credit Cards

Virtual credit cards are not universally applicable. Depending on your needs—whether for personal use, business expenses, or international transactions—different types of VCCs offer unique advantages. Below, we break down each type with real-world examples and ideal use cases.

A. Single-Use Virtual Cards (Burner Cards)

How They Work:

- Generate a unique card number that automatically deactivates after one transaction.

- No recurring charges are possible—perfect for trial subscriptions or one-off purchases.

Best For:

- Free trials (Netflix, Amazon Prime)

- Purchases from unknown websites

- Preventing merchant “bill creep” (unauthorized recurring charges)

Example Providers:

- Privacy.com (US only): Free for personal use, 1% fee for business.

- Revolut Disposable Cards: Works globally and supports multi-currencies.

B. Multi-Use Virtual Cards (Reloadable Cards)

How They Work:

- It functions like a traditional credit card but digitally.

- It can be reused until manually closed. It often allows spending limits and expiration date customization.

Best For:

- Subscription services (Spotify, SaaS tools)

- Freelancers receiving client payments

- Business travel expenses

Example Providers:

- Apple Card (Goldman Sachs): Seamless Apple Pay integration.

- Citi Virtual Cards: Available to existing Citi customers.

C. Merchant-Locked Virtual Cards

How They Work:

- It only works with a specific merchant (e.g., Uber, Amazon).

- If compromised, the damage is limited to one vendor.

Best For:

- Recurring payments with trusted merchants

- Reducing exposure in data breaches

Example Providers:

- Capital One Eno: Auto-generates virtual cards for online purchases.

- American Express Virtual Pay: Business-focused, vendor-specific cards.

Top Use Cases for Virtual Credit Cards

A. Secure Online Shopping

- Problem: Data breaches at retailers (e.g., Target, eBay) expose credit card details.

- Solution: Use a single-use virtual card when shopping on new or less secure websites.

Pro Tip: Set a spending limit slightly above the purchase amount to prevent overcharging.

B. Managing Subscriptions & Free Trials

- Problem: Companies make it difficult to cancel subscriptions (e.g., gym memberships).

- Solution: Use a virtual card with a $1 limit for free trials—auto-declines renewal charges.

Example Workflow:

- Sign up for a streaming service with a Privacy.com virtual card.

- Set expiration date to 1 month later.

- Even if you forget to cancel, the card won’t work for rebilling.

C. International Travel & Forex Savings

- Problem: Traditional cards charge 3% foreign transaction fees.

- Solution: Use a multi-currency virtual card (e.g., Wise, Revolut) with zero FX fees.

Bonus Hack: Load the card with the local currency before traveling to lock in exchange rates.

D. Freelancer & Remote Work Payments

- Problem: Sharing real bank details with clients increases fraud risk.

- Solution: Provide a virtual card number for invoices.

Top Picks:

- Payoneer Virtual Card: Ideal for freelancers on Upwork/Fiverr.

- Wise Borderless Card: Accept payments in multiple currencies.

E. Business Expense Management

- Problem: Employees overspend on corporate cards.

- Solution: Issue department-specific virtual cards with:

- Monthly spending caps

- Merchant restrictions (e.g., only for software purchases)

Top Business Providers:

- Brex: Startup-friendly corporate cards.

- Ramp: AI-powered spend controls.

Best Virtual Credit Card Providers in 2025: In-Depth Reviews

1. Revolut: Best for Travel & Multi-Currency

Revolut is a top choice for globetrotters. It is also popular among digital nomads. It offers a seamless way to manage money across borders. Its virtual credit card feature is packed with travel-friendly perks, making it ideal for international spenders.

Key Features

- Free virtual cards (create up to 200 disposable cards)

- Spend in 30+ currencies with no FX fees (on Premium/Metal plans)

- Biometric security (Face ID, fingerprint)

- Instant card freezing/unfreezing via app

- Budgeting tools with spending analytics

How to Get It

- Download the Revolut app (iOS/Android)

- Sign up and verify your identity (KYC process)

- Choose a plan (Standard = free, Premium = $9.99/month)

- Generate virtual cards instantly

Best For

- Frequent travelers needing multi-currency support

- Expats managing finances across countries

- Online shoppers wanting disposable card numbers

2. Privacy.com: Best for US Consumers

Privacy.com is a US-based leader in virtual card solutions, specializing in fraud prevention and subscription control. It’s perfect for consumers sick of hidden charges and data breaches.

Key Features

- Free personal accounts (business accounts: 1% fee per transaction)

- Merchant-locking—Block charges from specific vendors

- Browser extension for instant card generation at checkout

- Spending limits & expiration dates per card

- No credit check required

How to Get It

- Visit Privacy.com and sign up

- Link a U.S. bank account (debit cards also work)

- Start generating virtual cards immediately

Best For

- Americans avoiding subscription traps (gyms, streaming)

- Online shoppers wary of sketchy websites

- Parents creating cards for teens with spending limits

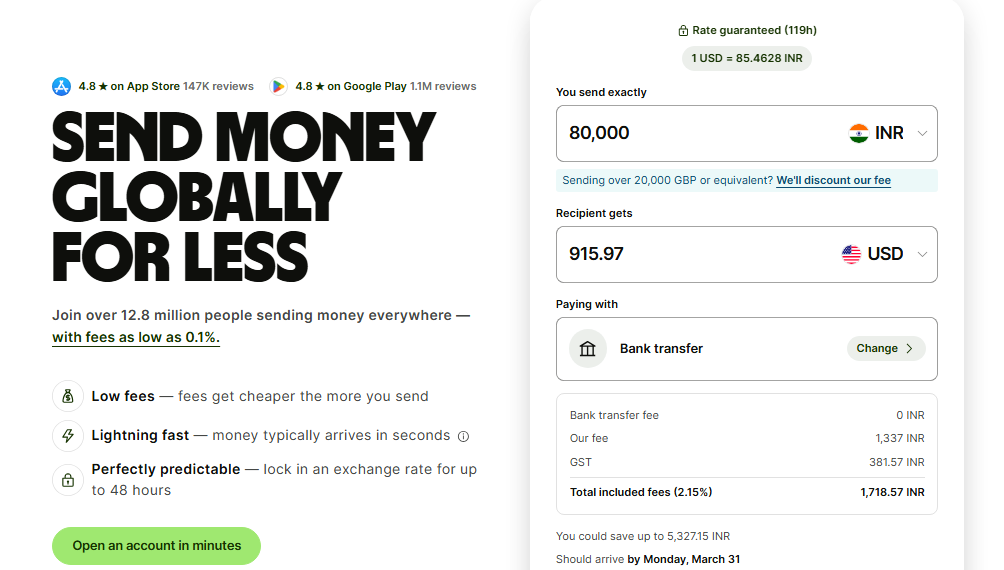

3. Wise (Formerly TransferWise): Best for International Payments

Wise is a powerhouse for cross-border transactions, offering virtual cards with real mid-market exchange rates. It’s a freelancer’s and expat’s favorite for avoiding bank fees.

Key Features

- Hold 50+ currencies and convert at optimal rates

- No hidden FX fees (unlike traditional banks)

- Works with Apple Pay/Google Pay

- One-time or reusable virtual cards

- Borderless account with local banking details

How to Get It

- Sign up on Wise.com

- Open a borderless account (free)

- Order a virtual card (available in supported countries)

Best For

- Freelancers getting paid internationally

- Expats sending/receiving money abroad

- Frequent Amazon/eBay shoppers buying from overseas

4. Apple Card: Best for iPhone Users

Apple Card, issued by Goldman Sachs, integrates flawlessly with the Apple ecosystem. Its virtual card lives in Apple Wallet and offers instant cashback.

Key Features

- Instant virtual card (no waiting for physical card)

- Daily Cash rewards (2-3% back on purchases)

- No fees (late payments, foreign transactions, or annual fees)

- Titanium physical card (optional)

- Spending tracking via Apple Wallet

How to Get It

- Open Apple Wallet on your iPhone

- Tap “+” → Apple Card

- Apply (soft credit check) and get approved instantly

Best For

- iPhone users deeply embedded in Apple’s ecosystem

- Cashback seekers (3% back at Apple, 2% with Apple Pay)

- No-fee card enthusiasts

5. Citi Virtual Cards: Best for Existing Citi Customers

Existing Citi credit cardholders can benefit from Citi’s virtual card feature. This feature provides an additional layer of security for online purchases. You can check the updated information about these Citi virtual cards.

Key Features

- Free for Citi cardholders (no extra cost)

- Real-time fraud alerts via text/email

- Customizable spending limits & expiration dates

- Works with all major Citi cards (Double Cash, Custom Cash, etc.)

How to Get It

- Log in to Citi’s mobile app or online banking

- Navigate to “Virtual Card Numbers” under card services

- Generate a new virtual card in seconds

Best For

- Citi bank customers wanting added security

- Online shoppers using Citi rewards cards

- Business travelers needing temporary card numbers

Final Verdict: Which Virtual Card Should You Choose?

| Provider | Best For | Standout Feature |

|---|---|---|

| Revolut | Travelers | 30+ currencies, disposable cards |

| Privacy.com | US users | Merchant-blocking, free personal use |

| Wise | International payments | Best FX rates, 50+ currencies |

| Apple Card | iPhone users | Instant cashback, no fees |

| Citi Virtual | Citi customers | Free, real-time fraud alerts |

Pro Tip: If you need multiple use cases, consider using 2+ services (e.g., Wise for travel + Privacy.com for subscriptions).

Frequently Asked Questions (FAQs) on Virtual Credit Cards

Are virtual credit cards safe to use?

Yes, virtual credit cards are generally very safe for online purchases. They provide an extra layer of security by masking your real card number with a temporary virtual account number. It protects your actual account in case the virtual card details are compromised. If you use them properly, virtual credit cards greatly reduce the risk to your real accounts.

Do virtual credit cards work the same as regular cards?

Virtual credit cards work very similarly to regular credit cards when online purchases. The virtual card number is entered on the merchant site and processed through the card network like a regular card. The only difference is behind the scenes, where the virtual number is linked back to your real account for the funds to be drawn from your available balance or credit limit.

Can virtual cards be used in stores?

Most virtual credit cards can only be used for online, phone or mail-order purchases. The card numbers cannot be used to make purchases in brick-and-mortar retail stores or when direct swiping of the card is required. Some newer digital wallet services may help expand virtual card use to in-person transactions.

Do I need to update all my online accounts to use virtual cards?

One of the benefits of virtual cards is you can use them to make purchases anywhere online without updating your existing accounts. Just generate a new virtual card number specifically for each merchant where you shop online. Since the virtual card masks your real account number, you do not have to change any of your current online accounts.

Are there fees to use virtual credit cards?

Many banks provide virtual credit card services for free to their banking and credit card customers. Third-party virtual card companies may charge signup or monthly usage fees so that the costs can vary. However, there are affordable options that provide basic virtual card features for minimal or no cost for most consumers.

Conclusion: Choosing the Best Virtual Credit Card in 2025

Digital payments are constantly evolving. Virtual credit cards (VCCs) have become essential tools for secure online transactions. They help in fraud prevention and smart spending control. Whether you’re a frequent traveler, online shopper, freelancer, or business owner, there’s a perfect virtual card solution for your needs.

Key Takeaways from Our Virtual Credit Card Guide

- For travelers and digital nomads, Revolut stands out with multi-currency support and disposable virtual cards perfect for international spending

- US consumers should consider Privacy.com for its merchant-blocking features and subscription management tools

- Freelancers and expats will benefit from Wise’s borderless accounts and best-in-class exchange rates

- iPhone users get unbeatable value from the Apple Card with instant cashback and seamless Apple Pay integration

- Existing Citi customers can enhance security with Citi Virtual Cards’ real-time fraud alerts

Why Virtual Credit Cards Are the Future

The global virtual card market is booming because these digital payment solutions offer:

- Superior security with tokenized, disposable card numbers

- Better spending control through customizable limits and expiration dates

- Cost savings on foreign transactions and subscription traps

- Convenience with instant issuance and digital wallet integration

Final Recommendation

Before choosing a provider, consider:

- Your primary use case (travel, subscriptions, business expenses)

- Fee structures (FX fees, monthly charges)

- Compatibility with your existing financial ecosystem

- Security features like biometric authentication

For maximum flexibility, many users combine services – like using Wise for international payments alongside Privacy.com for US merchant transactions.

As we move further into 2025, expect to see more innovations. These include blockchain-based VCCs and AI-powered spending insights. Additionally, 5G-enabled instant card generation will become more common. The virtual credit card revolution is just beginning. By adopting these tools now, you will be ahead in digital finance security and convenience.

Ready to upgrade your payment experience? Compare our top picks and start enjoying safer, smarter transactions today!

Great work Satish garu. I really didn’t know concept of virtual credit card. It really great help to the people including me who are struggling to pay international payments through credit card. Thanq once again….